Udemy - Chargeback Reason Codes in Card Payments

"softddl.org"

5-11-2021, 14:07

-

Share on social networks:

-

Download for free: Udemy -

-

Hot & New | Created by Vasco Patrício | Last updated 9/2021

Duration: 1h27m | 6 sections | 21 lectures | Video: 1280x720, 44 KHz | 879 MB

Genre: eLearning | Language: English + Sub

Hot & New | Created by Vasco Patrício | Last updated 9/2021

Duration: 1h27m | 6 sections | 21 lectures | Video: 1280x720, 44 KHz | 879 MB

Genre: eLearning | Language: English + Sub

Covering the usual types of reason codes in payment chargebacks, what they represent, and what merchants should do

What you'll learn

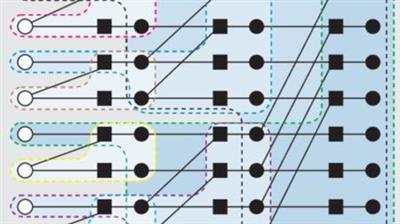

The usual types of chargeback reason codes in credit card payments

The four main categories of chargeback reason codes (fraud, authorization error, processing error and consumer disputes)

The most frequent types of fraud reason codes (fraudulent processing, EMV shift, others)

The most frequent types of authorization reason codes (missing authorization, declined authorization, stolen card, etc)

The most frequent types of processing error reason codes (late presentment, currency mismatches, others)

The most frequent types of consumer dispute reason codes (disputes over goods, credit not processed, others)

Requirements

None!

Description

THE;CHARGEBACK;WAY;OF;LIFE

You may know that a merchant (or their bank, the acquirer/merchant bank), chargebacks are a nightmare.

In short, a credit card owner claims they should obtain their money back due to something that went wrong in a transaction.

Fraud, disputes over the goods, authorization errors, and many other types come in here.

Chargebacks represent difficult obstacles for both acquiring and issuing bank.

Each chargeback is usually represent by something called the "reason code", which (unsurprisingly), states the reason for that chargeback.

Therefore, for any payment professional that deals with credit card transactions, knowing the usual reason codes is essential.

Naturally, these change depending on the credit card company. But there are general patterns.

In this course, you are going to learn about the most common types of chargeback reason codes.

P.S.:;This course is part of my bigger "Introduction to Dispute Resolution;Course".

\n

\n

THE;PERFECT;COURSE...;FOR;WHOM?

This course is targeted at different types of people. Naturally, all current or future dispute management professionals will find this course useful. But any other professional that aims to know more about how disputes are resolved will find it useful.

More specifically, the ideal student for this course is someone who:\n- Will directly deal with dispute management or resolution;\n- Wants to know more about the different types of dispute resolution;(both litigation and ADR, offline or not);\n- Wants to specifically know how to address disputes involving merchants and cardholders (as a bank or merchant);\n- Wants to know more about the different types of reason codes for chargebacks (and how to prevent them);\n- Wants to know how to perform dispute resolution using multiple methods;(negotiation, mediation and/or arbitration);

\n

\n

LET;ME;TELL;YOU... EVERYTHING

Some people - including me - love to know what they're getting in a package.

And by this, I;mean, EVERYTHING that is in the package.

The four major categories of chargeback reason codes:;fraud, authorization errors, processing errors,; customer disputes;

The usual types of chargeback reason codes due to fraud (not authorised or recognised transactions, fraudulent processing, monitored merchant or monitored card, the EMV liability shift);

The usual types of chargeback reason codes due to authorization issues (missing or declined authorisation, card in recovery/lost card/stolen card, invalid authorization information),

The usual types of chargeback reason codes due to processing errors (late presentment, invalid transaction code or invalid transaction data, duplicated payment or paid by other means, currency mismatches);

The usual types of chargeback reason codes due to consumer disputes (mismatches in terms of goods - counterfeit, misrepresented, not delivered, others - cancelled or incomplete transactions, credit not processed);

Buy Premium From My Links To Get Resumable Support,Max Speed & Support Me

Links are Interchangeable - No Password - Single Extraction

The minimum comment length is 50 characters. comments are moderated